Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

Estates and the nil rate dividend band and gross interest

Two changes, effective from 6 April 2016 will result in more estates having to settle tax liabilities arising during the period of administration. Prior to 6 April 2016 most...

Secondary Annuities Market: Why Plans Were Abandoned

What Was the Secondary Annuities Market? The secondary annuities market was a proposed system allowing individuals to sell their annuities for a lump sum. The idea was...

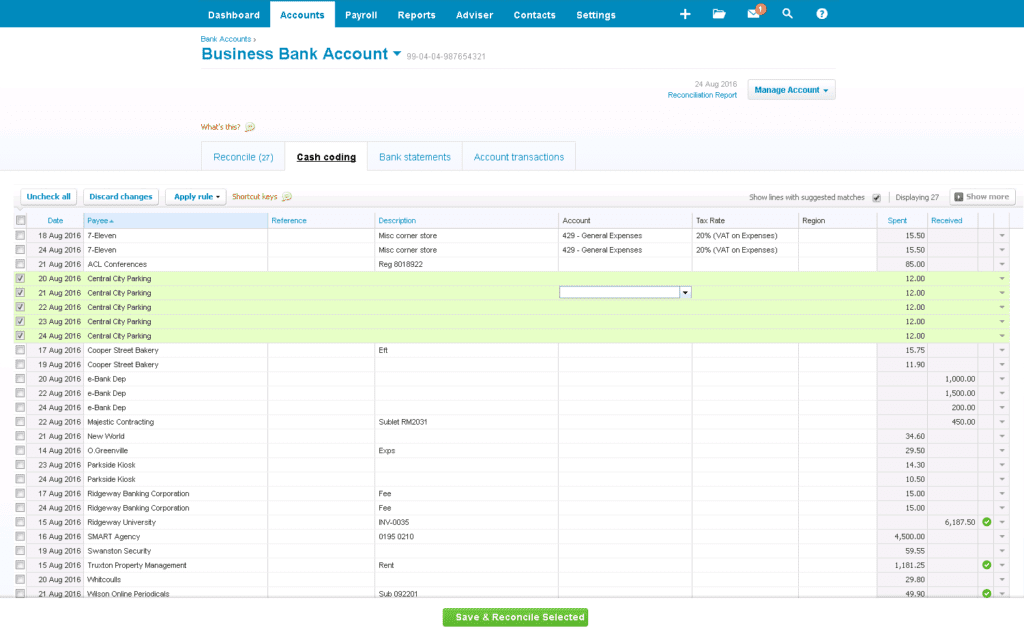

Cash Coding on Xero

Do you have lots of transactions that all relate to the same thing? Use cash coding to reconcile multiple transactions rather than creating a payment for each one...

Invest with HMRC?!

Following the reduction in base rate in August from 0.5% to 0.25%, HMRC have amended the interest rate due on late paid tax. HMRC have reduced all interest charge rates from...

Protecting Your Pension Savings: Lifetime Allowance Tax Charges

The lifetime allowance is the maximum amount you can accumulate in pension savings without incurring additional tax charges. To protect individuals with significant pension...

Entrepreneur’s relief and resignation

Understanding Entrepreneurs’ Relief and Resignation Timing Entrepreneurs’ Relief, now called Business Asset Disposal Relief, allows business owners to pay a reduced 10%...

Stamp duty and mortgages

When Is Stamp Duty Payable on a Mortgage Transfer? Stamp Duty Land Tax (SDLT) is generally not payable when property is transferred with no consideration. However, an...

Understanding Employment Allowance Eligibility for Small Employers

Understanding Employment Allowance Eligibility for Small Employers

Deposits and liquidation – caveat emptor when it comes to VAT

Deposits, VAT, and Supplier Liquidation When a business pays a deposit for goods or services, a VAT point is usually created, meaning VAT must be accounted for at that stage....

Ready to make the first step?