Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

Second hand schemes and VAT

Businesses selling second-hand goods, antiques, or works of art may benefit from a second-hand VAT scheme. Instead of paying VAT on the full selling price, they only account...

Dividends and personal allowances

Dividends and personal allowances are a hot topic at the moment. And why? Well, since 6 April 2016, the first £5,000 of dividend income has been taxed at 0%. However, this...

Spot the ball – exempt or taxable (for VAT)

Spot the Ball and VAT: The Court Ruling A recent Court of Appeal ruling has confirmed that Spot the Ball competitions qualify as a game of chance, making them exempt from VAT....

RTI late filing easement

RTI Late Filing Easement Extended Real-Time Information (RTI) reporting is a crucial requirement for employers, ensuring that HMRC receives timely payroll data. Previously,...

SEIS investments

Another reminder! To be eligible to raise funds under SEIS the company’s gross assets must be valued at no more than £200,000, and it must not have more than 25 full-time...

Transfer of a going concern (VAT)

If a business is transferred from one type of legal entity to another the turnover of the old legal entity must be taken into account when determining whether VAT registration...

Charitable trusts and the single rate band

Charitable trusts are typically exempt from income tax, making them a useful structure for managing donations and assets intended for charitable causes. However, complications...

Residential buy to lets and VAT

If you are in business as a sole trader and registered for VAT, while you do not have to account for VAT on the letting income you might be able to recover the VAT on the...

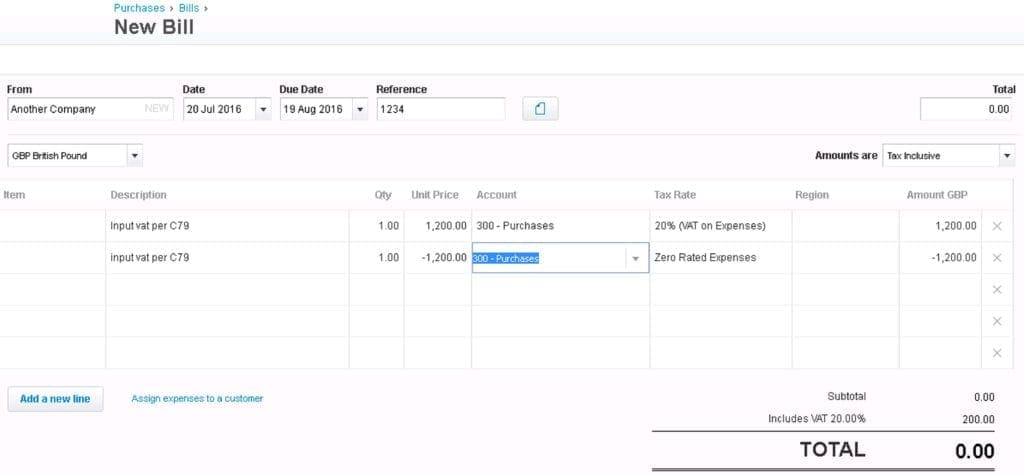

Xero Help – Input VAT on Import

A common question we receive is how to correctly account for input VAT on imports in Xero. If your business imports goods and needs to reclaim VAT, it’s essential to record...

Ready to make the first step?