Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

IHT Planning and Gift with Reservation of Benefit

Have you been thinking about inheritance tax (IHT) lately? It's surprising how often it rears its head. But, there are a couple of main anti-avoidance rules to be...

What does the Labour election result mean for tax planning?

I suspect the fact we now have a new Labour Prime Minister in Keir Starmer won’t come as a particular surprise to anyone. Taxation was a subject that frequently...

Thoughts from Xerocon 2024

Attending XeroCon always brings a fresh wave of excitement and innovation to the world of accounting. And, this year was no exception! At the forefront of these...

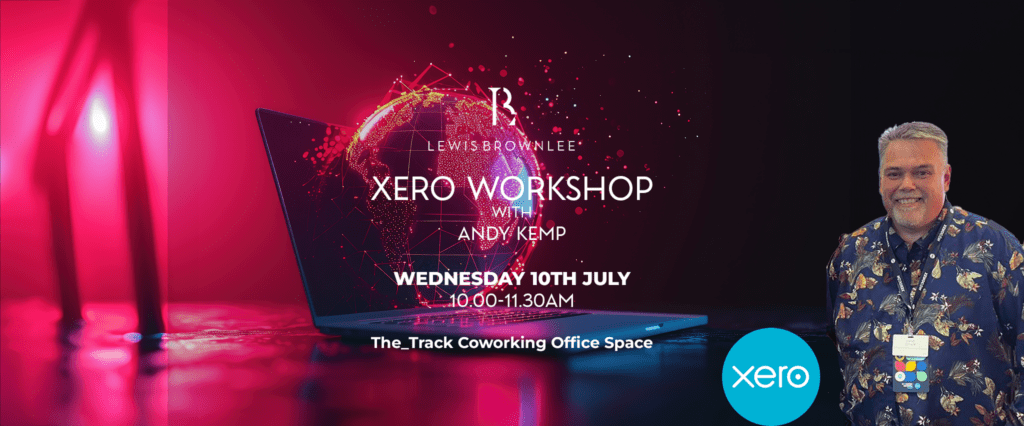

Xero with Andy Kemp – Keeping Pace at The_Track!

Are you a small business owner, accountant, or simply curious about cloud accounting? Join us for an exclusive workshop to unlock the Power of Xero with our very...

Lewis Brownlee Win Health & Well-Being Excellence Award

We are thrilled to announce our win at the Chichester Chamber of Commerce Chichester and Bognor Business Awards, held on 14th June. We took home the prestigious...

Child Benefits – 2024 Changes and what they mean for you!

As experts in Tax, it is important for us to keep people abreast of changes in legislation. It's also important to remind people of useful information at the...

What happens if I miss the P11D deadline?

What happens if I miss the P11D deadline? It's a question we get asked a lot and understanding the repercussions is essential for businesses. The P11D and P11D(b)...

What do I do if I’ve got my P11D figures wrong?

Realising you have got your P11D figures wrong can be daunting. However, there are steps you can take to rectify errors and ensure compliance with HMRC regulations....

P11D – are you generous with mileage payments?

Navigating P11D and mileage payments can be complex. It's not uncommon for employers to remunerate staff for business mileage. But, do such payments constitute a...

Ready to make the first step?