Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

Buy to let – personal or company ownership

There is no simple answer to which is the best option, following the significant changes made to how the income is taxed when property is not held through a company. Three...

New state pension entitlement

How Contracting Out Affects Your New State Pension Entitlement The new state pension entitlement depends on your National Insurance (NI) record. If you were ever contracted...

Class 1A NIC Payments for the year ended 5 April 2016

Remember to use your 13 character Accounts Office reference followed by 1613 to make sure that the payment is allocated correctly. Class 1A NIC Payment is due on benefits in...

Advisory fuel rates – small increases from 1 June in most rates

Employers can continue to use the old rates until 30 June. These advisory fuel rates are used to determine the rate of reimbursement required from employees who do private...

Stamp duty and second homes – relief extended

Understanding Stamp Duty on Second Homes Since 1 April 2016, buyers of second homes must pay an extra 3% Stamp Duty Land Tax (SDLT) surcharge. This applies even if the second...

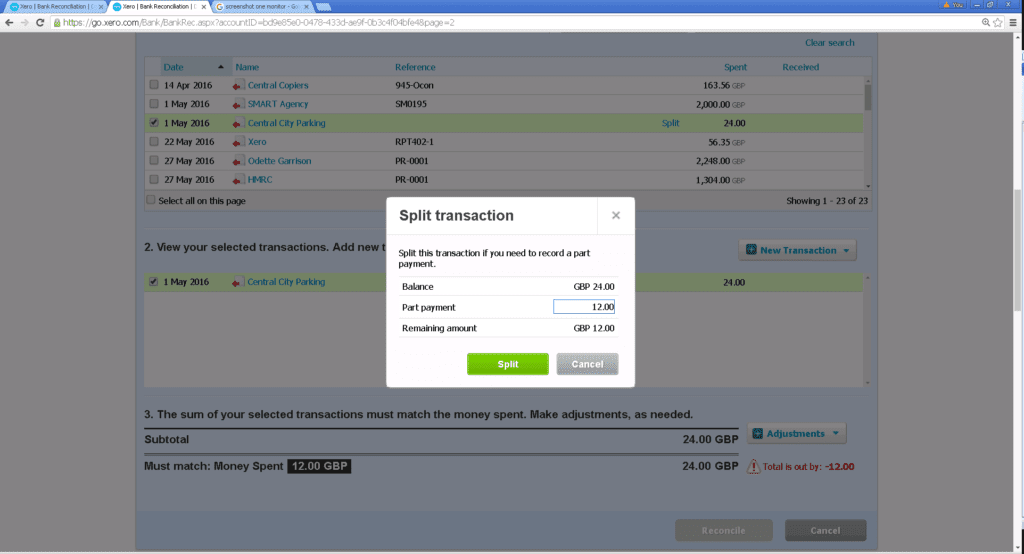

Xero Support – Paying a supplier invoice in 2 (or more) payments

If a purchase invoice in Xero is cleared by multiple payments, Xero will not automatically be able to match the bank transactions to the correct item. Below are the steps on...

Lets Get Fiscal! The training walk across the Southdowns!

Two weeks ago the team went for a 20 mile walk in the scorching heat across the Southdowns in preparation for the gruelling 40 mile walk in July. The walk started at Devils...

Losses and transfer of trade

Sometimes a loss making sole trader will incorporate in the expectation that the corner has been turned and the business becomes profitable or the protection of limited...

Xero Updates and Features – The latest from Xero!

The big news in Xero Updates and Features this month is BARCLAYS BANK FEEDS WILL BE HERE NEXT WEEK – Hooray!! Other not quite so big news: The bank statements have had a bit...

Ready to make the first step?