Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

VAT – exemption for studies taught ordinarily at school

In the UK, VAT exemption for education applies to subjects that are ordinarily taught at schools or universities. This means that where a course aligns with mainstream...

Team LB at the CCCI Charity Quiz!

This week, Team LB took part in the CCCI charity quiz. Hosted by the Chichester Chamber of Commerce & Industry, the event was held to raise awareness and funds for Love...

Payrolling benefits

Mentioned before we believe but a reminder that if you have an informal agreement to payroll benefits in kind, you need to reapply before 6 April 2016 to do so for the year...

Rolling stones gather no MOSS!

Nothing to do with nature! HMRC have issued guidance as to simplification measures for UK businesses trading below the VAT registration threshold (currently £82,000), that...

Pitfall with cars – No 2 – to lease or not to lease

Leasing a car through a company can seem like a cost-effective way to provide employees or directors with a vehicle. However, there are key company car lease tax pitfalls that...

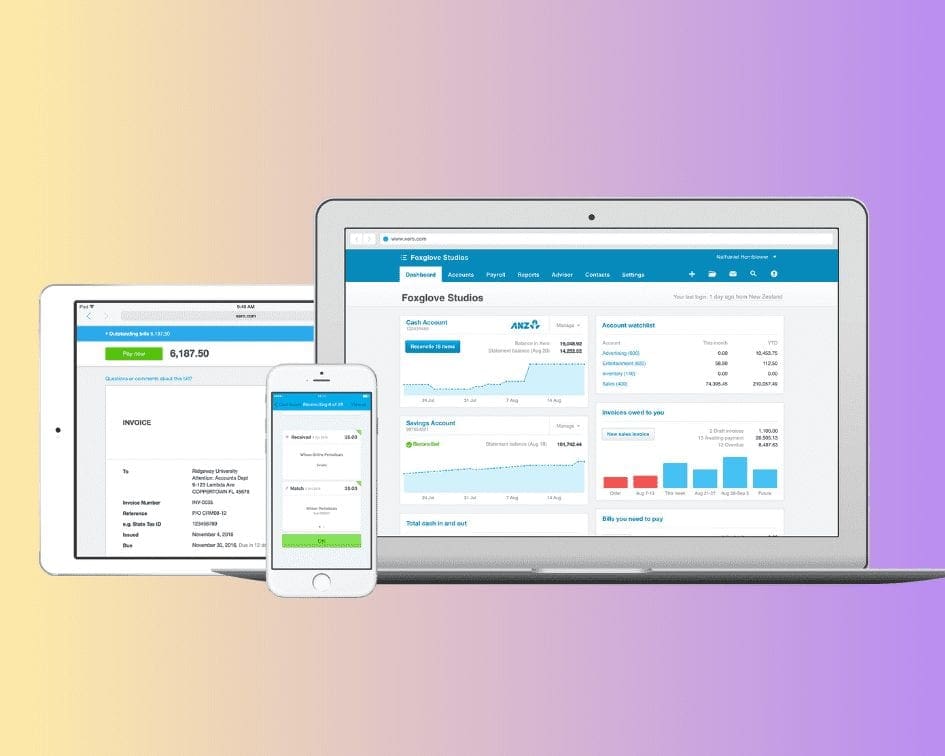

Xero Add Ons – April

For those involved in farming and agriculture Xero now has as an add-on partner specific for your business, introducing: Farmflo With bespoke modules to cover Dairy, Beef,...

Pitfall with cars – No 1 – pooled cars (not pedalos!)

It is very difficult to make a company car a pool car and thereby avoid the benefit in kind provisions. To be exempt from such charges the car; Must actually be used by more...

Cycle Chartres 2016!

It’s that time of year again!! With the May Day Bank Holiday fast approaching, a team from Lewis Brownlee will be taking part in the annual Cycle Chartres event! The riders...

Enhanced Capital allowances – making the most!

From 1 January 2016 the annual investment allowance reduced from £500,000 to £200,000. If you find that your capital expenditure already exceeds the allowance available look a...

Ready to make the first step?