Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

Inheritance tax (IHT) numbers

If you need to pay Inheritance Tax (IHT) on a deceased’s estate or a large gift into a trust, you may need an Inheritance Tax number before making the payment. HMRC uses this...

CGT annual exemption – use now while stocks last!

Each tax year, individuals receive a Capital Gains Tax (CGT) annual exemption, allowing them to make gains up to a set threshold without paying CGT. However, this exemption...

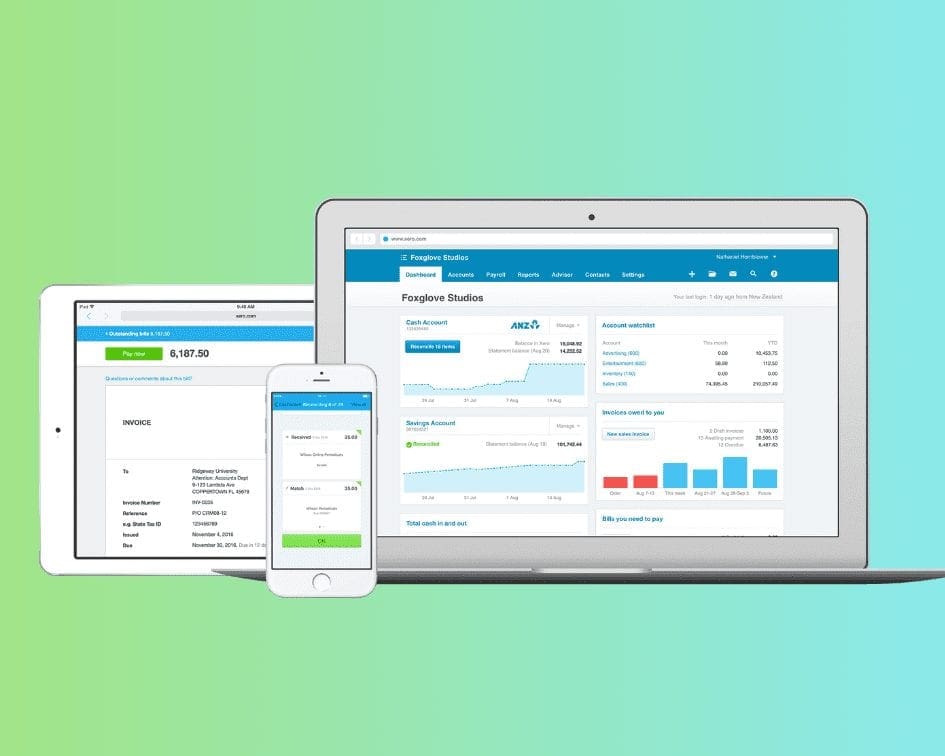

Xero updates and tips – The latest from Xero!

It has been a quiet month on the Xero front! So, we are going to spoil you with a few Xero updates and tips! Barclays bank feeds not quite ready, hopefully fully running from...

Charging your children rent?

With effect from 6 April 2016 the tax free amount of rental income you can receive from renting out a room or rooms in your home increases from £4,250 to £7,500 per annum. If...

Research and Developments Credits

At Lewis Brownlee, we are proud to announce that the Research and Development Tax Credits claims we submitted in March exceeded £3 million—a new record for us! This milestone...

Let’s get fiscal! Training at Queen Elizabeth Country Park!

The training walk at Queen Elizabeth Country Park! Sponsor us by visiting: https://www.action.org.uk/sponsor/LewisBrownlee Last Sunday the team were out walking 15 miles in...

Lewis Brownlee raised awareness for World Down Syndrome Day

Lewis Brownlee raised awareness for World Down Syndrome Day on Monday 21st March by the staff wearing lots of socks! There was also a cake sale to raise funds for Chichester...

National Insurance Employment Allowance

The National Insurance Employment Allowance is a valuable relief that allows eligible businesses to reduce their Employer’s National Insurance Contributions (NICs). From 6...

Xero Add-ons – March

This month’s Xero Add Ons! Software that integrates with Xero to make managing you company easier and more efficient – we are looking at Tripcatcher... Tripcatcher – The...

Ready to make the first step?