Blogs

Stay in the know

Welcome to the Lewis Brownlee Chartered Accountants Blog

Your trusted source for expert insights on UK tax, accounting, and business finance. Whether you’re a small business owner, a sole trader, or a larger enterprise, our blog offers valuable tips, updates on tax regulations, and practical advice to help you navigate the financial landscape with confidence.

Stay informed with the latest industry trends and guidance from our team of experienced Chartered Accountants.

Explore our articles and discover how we can support your financial success.

Marriage Allowance

Registration opens for new Marriage Allowance HMRC have recently announced that married couples can now register their interest in applying for the new Marriage Allowance ...

The Big Move!

We’re thrilled to share some exciting news—we’ve officially moved to a fantastic new office in Chichester! This move marks a significant milestone for us and brings enhanced...

Capital gains tax for second homes

Capital Gains Tax for second homes is an important consideration for property owners, especially with the rule changes introduced from 6 April 2015. One consequence of the new...

State pension changes from 6 April 2016

Understanding the Latest State Pension Changes The state pension changes introduced from 6 April 2016 mark a significant shift in how pensions are calculated and accessed. The...

Employers NIC break for younger staff

Employers NIC Break for Younger Staff Hiring younger staff just became more cost-effective for employers. From 6 April 2015, businesses can benefit from a significant change...

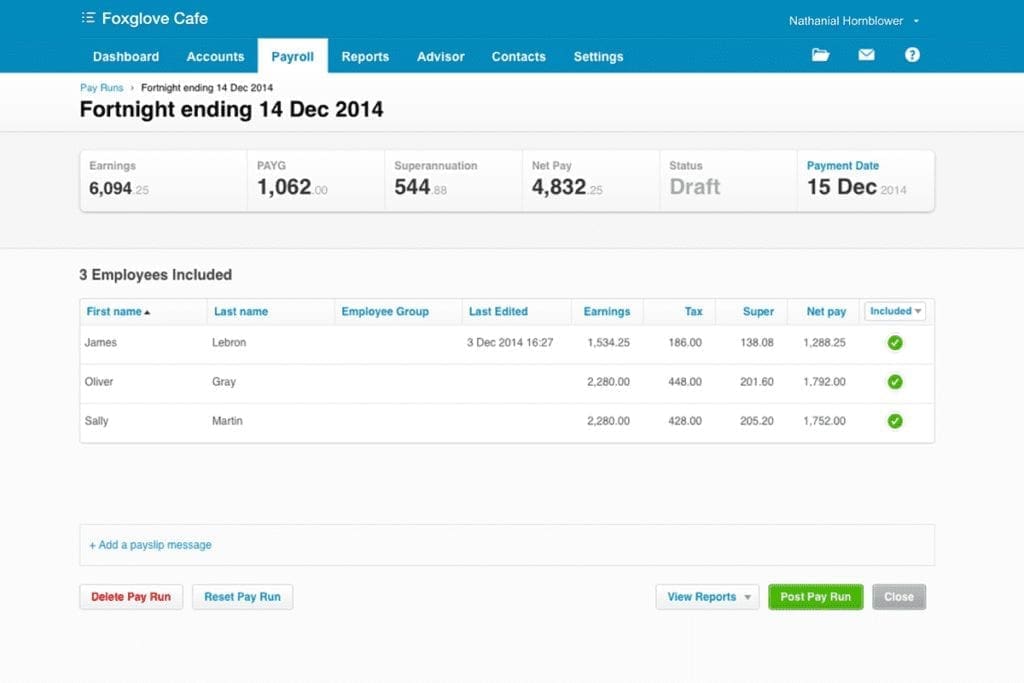

New Xero Payroll Function

This week some of the Lewis Brownlee team took time out of the office to attend “Xerocon” in London, and what a worthwhile experience it was...

The London Marathon

Lewis Brownlee supports Give 4 B.E.T.H. in the London Marathon!

National Insurance Refunds

National Insurance refunds can be a valuable source of relief for individuals who have overpaid in a tax year. This often occurs when someone is both employed and...

Research and Development Tax Credit

How HMRC’s Advance Assurance Scheme Can Help with R&D Tax Credit Claims R&D tax credit claims are an increasingly valuable service we offer, helping clients unlock...

Ready to make the first step?