BARCLAYS BANK FEEDS ARE HERE AT LAST!!

Other news:

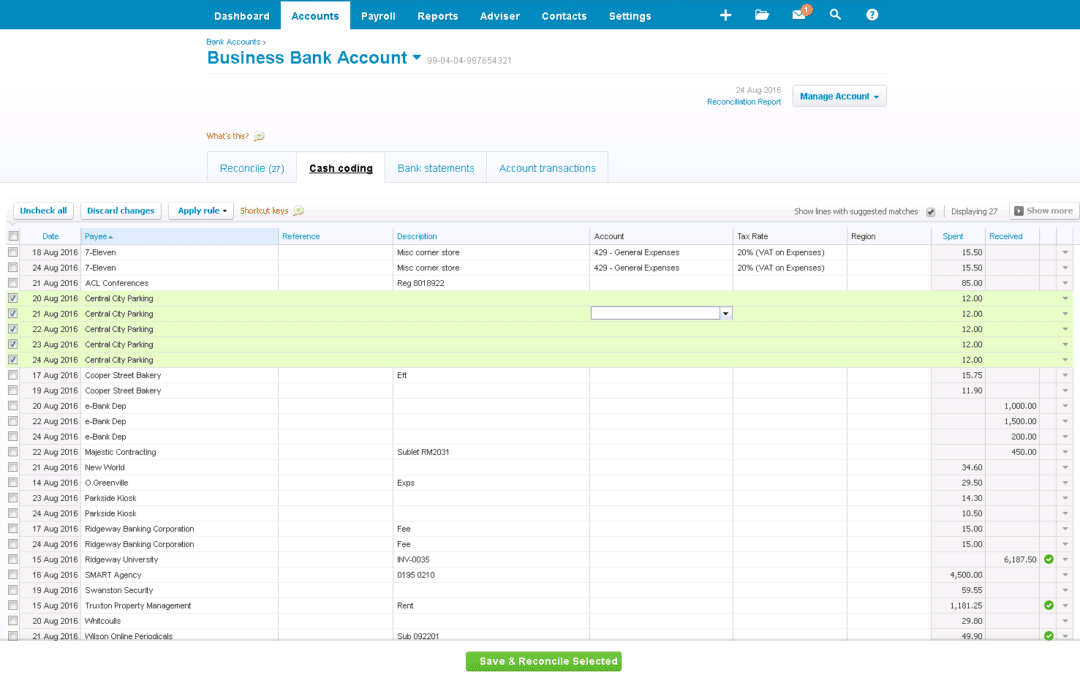

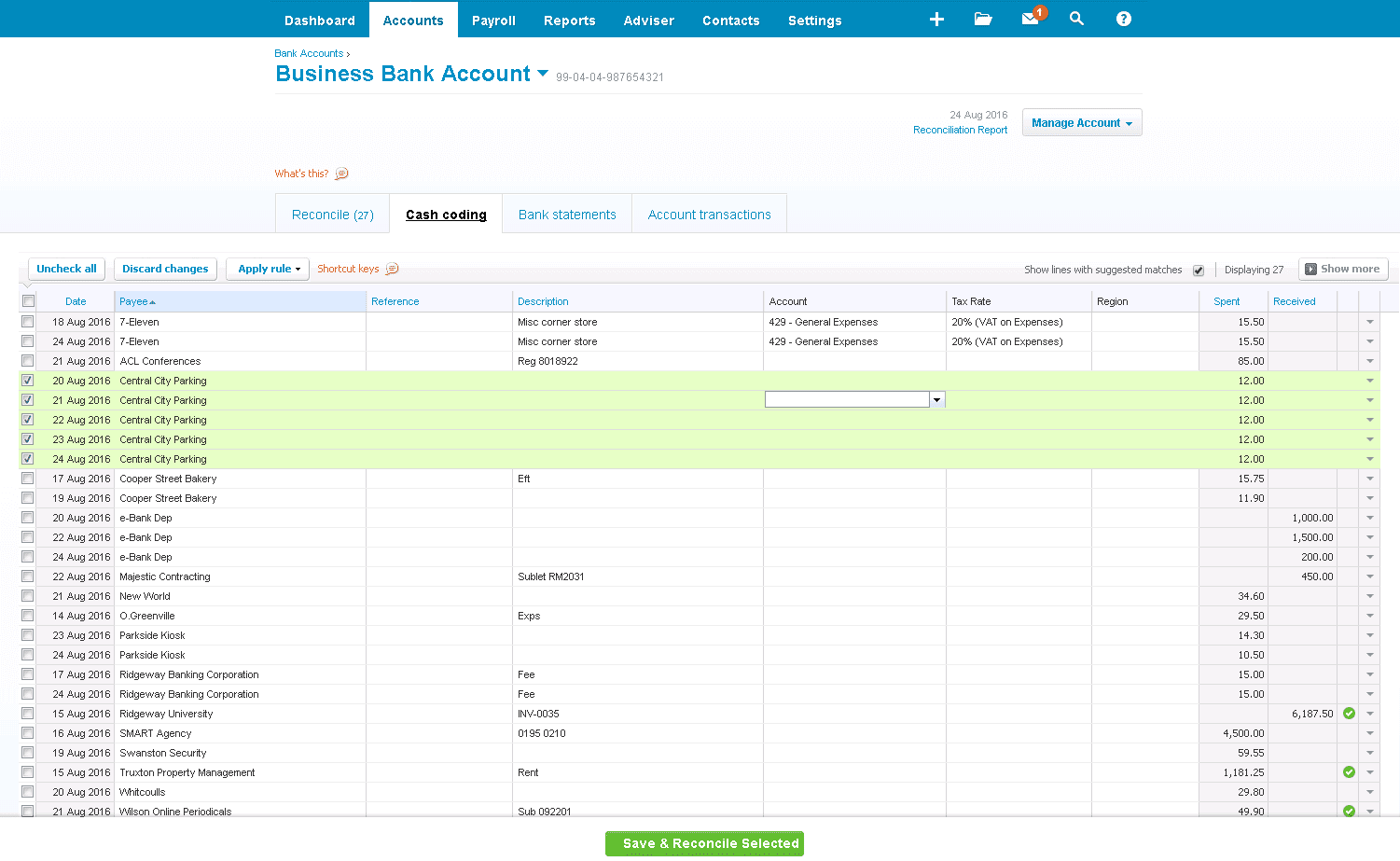

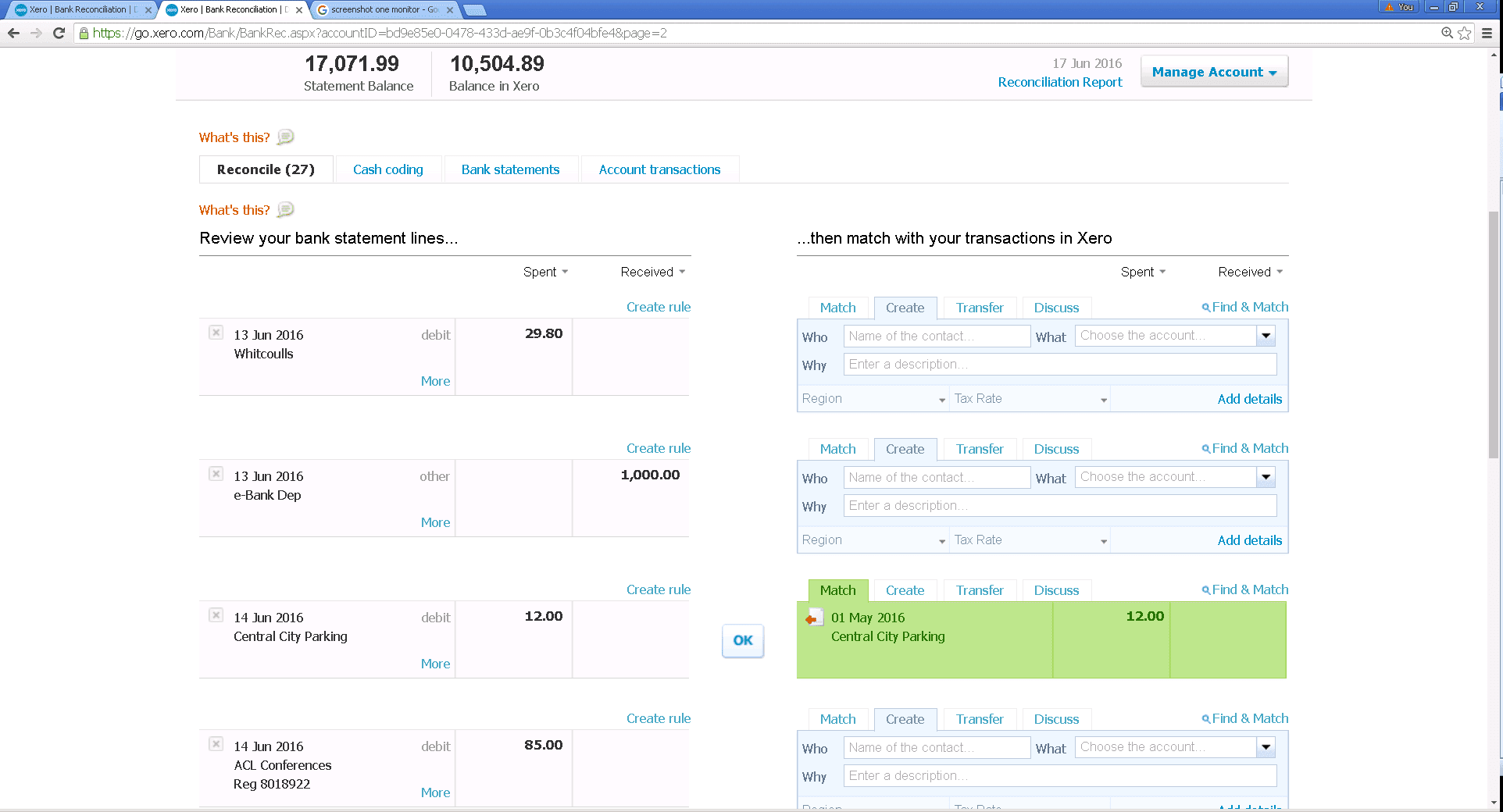

Uncoded statement lines

If you have the Adviser user role, you can export a list of unreconciled statement lines to a PDF or CSV file for clients to work with offline.

- Go to Accounts, then click Bank Accounts.

- Click Uncoded Statement Lines.

- Select a bank account, date range, and sort order.

- Click Update.

- Click PDF or CSV to download the file.

- Clients can add information directly in the file in the Your Comments column.

Copy from last invoice

If you have a repeat invoice for the same customer you can now copy item from the last invoice. Once an invoice has been approved this functionality is then available.

Start a new invoice

- Enter the contact

- Click on the add items tab

Microsoft Power BI

Microsoft Power BI is a business analytics tool to analyse data and share insights.

If you want to dive deep into your data, this is the way to do it. Microsoft Power BI complements Xero financial data with Microsoft Power BI to deliver powerful analytics and compelling data visualizations. And you don’t need any IT support to make it work. With the click of a button your financial data in Xero can be paired with data from other sources – such as CRM, marketing and support systems – to surface new insights. These can be saved as graphs and images to give you a visual snapshot of how your business is tracking.

A reminder that Xero will be moving their customers’ data to a new platform.

Xero will be down while your data is being transferred. The transfers will take place between 7 and 9 pm on Saturdays starting in June.

You will be warned in advance of your move day and will also get a 15 minute warning just before hand.

Once you have had the warning please do not go back into Xero for a couple of hours.

See the link below for up to date information about the move:

https://www.xero.com/blog/offline-status-page/?mkt_tok=eyJpIjoiWVdOa1pXWmlabU15TW1KaCIsInQiOiJSanZIdUNoREhBMmR2cHVcL3F4aGxyN09yemVrcnY2MFh2cDVteUVVU0dBTVg4WFRuaXhaaFhcL1JHeU12eEMxZHZKOWRkUGw4SFJJOWswcHlrYTc4TE5aRUhDTEJ4dStLZHNMaHh6R0pqTVwvbz0ifQ%3D%3D

For more information have a look at Xero’s website.

Any questions on these or Xero in general please contact us.