Domestic VAT Reverse Charge for construction services

Back in 2019 changes to the way the construction industry accounts for VAT were announced. The domestic reverse charge mechanism was originally planned to come into effect on 1 October 2019 but was delayed until 1 October 2020 due to Brexit. This date was further pushed back due to Covid-19 and is now due to be implemented from 1 March 2021.

We have also recorded a webinar on the subject which can be found on our YouTube Channel and is at the bottom of the blog 👇

WHO DOES THIS APPLY TO?

- You must use the domestic reverse charge if you are VAT registered in the UK, supply building and construction industry services and:

- Your customer is registered for VAT in the UK

- Payment for the supply is reported within the Construction Industry Scheme (CIS)

- The services you supply are standard or reduced rated

- You’re not an employment business supplying either staff or workers

- Your customer has not given written confirmation that they are an end user of intermediary supplier

- If you supply goods only, they will not fall under the domestic reverse charge. If you supply goods and services, the goods will be subject to the reverse charge along with the service supplied.

A full list of services this affects can be found on: https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services.

This will not affect zero-rated supplies, such as services supplied in building a new dwelling.

WHAT IS THE DOMESTIC REVERSE CHARGE?

For certain supplies of construction services, the customer will be liable to account for the VAT in respect of those purchases rather than the supplier. This is being brought in as a fraud elimination measure and to counter other forms of tax loss in the sector.

The basic principle of a domestic reverse charge is that the responsibility for accounting for output tax on a supply made by a VAT registered supplier to a VAT registered customer passes from the supplier to the customer.

Under normal circumstances when a supplier sells goods or services to a VAT-registered customer, the supplier will charge VAT on a VAT invoice. The supplier declares the VAT to HMRC as output tax on their VAT return by entering it in box 1. The VAT-registered customer will claim the VAT back as input tax by entering it in box 4 of their return.

With the domestic reverse charge, the supplier ceases to account for the output VAT. Instead, the customer will account for both the output VAT, in box 1, and the input VAT, in box 4.

For example:

- Subcontractor makes a sale of £1,000 net to a contractor who is not an end user, the subcontractor will invoice and receive £1,000 from the contractor (ignoring CIS tax).

- Subcontractor VAT return – box 1 will be £nil, box 6 will show the net sale of £1,000. No VAT is due to HMRC on this sale

- Contractor VAT return – box 1 will show £200, box 4 will show £200, box 7 will be £1000. No VAT is due to HMRC for this supply as box 1 and 4 effectively cancel each other out.

END USER OR INTERMEDIARY SUPPLIER

For reverse charge purposes consumers and final customers are called end users. They are businesses that are VAT registered and CIS registered but do not make onward supplies of the building and construction services supplied to them. The reverse charge does not apply to supplies to end users where the end user tells their supplier in writing that they are an end user.

Intermediary suppliers are VAT and CIS registered businesses that are connected to or linked to end users. If intermediary suppliers buy constructions services and re-supply them to a connected or linked end user without making material alterations to the supplies, they are treated as if they’re end users and the reverse charge does not apply.

To be connected or linked to an end user, intermediary suppliers must either:

- Have a relevant interest in the same land where the construction works are taking place (for example landlord and tenant)

- Be part of the same corporate group or undertaking

The notification of end user or intermediary status can be made by post, email or can be included in a contract. This notification must be kept in the business’s records.

Example of wording to be used:

‘We are an end user for the purposes of section 55A VAT Act 1994 reverse charge for building and construction services. Please issue us with a normal VAT invoice, with VAT charged at the appropriate rate. We will not account for the reverse charge.’

If a written notification is not made the customer will be liable for accounting for the VAT under the reverse charge.

THE 5% DISREGARD

Normally if any of the services in a supply are subject to the domestic reverse charge, all other services supplied will also be subject to it. However, if the domestic reverse charge part of the supply is 5% or less of the value of the whole supply normal VAT rules will apply.

SHOULD I APPLY THE REVERSE CHARGE?

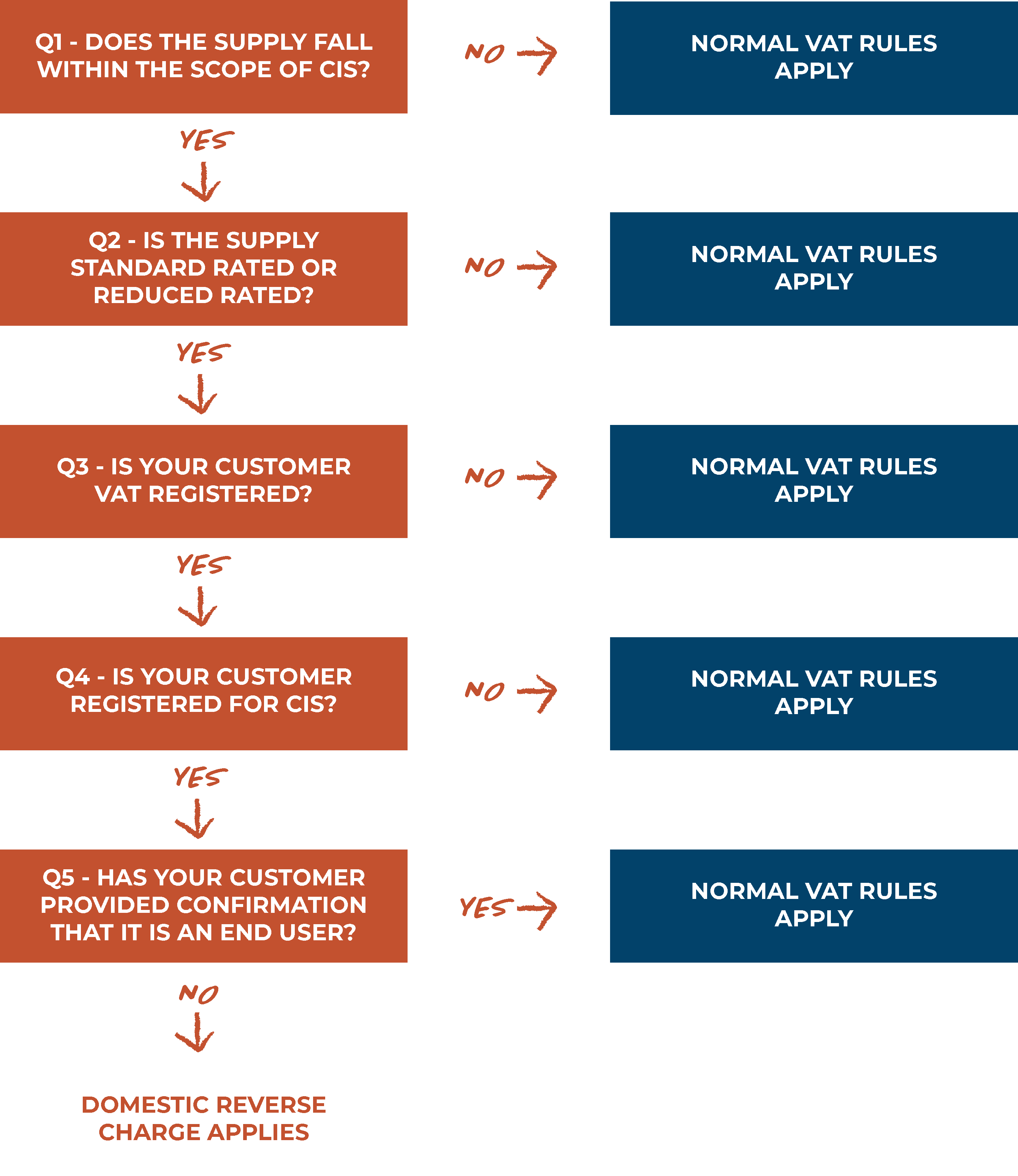

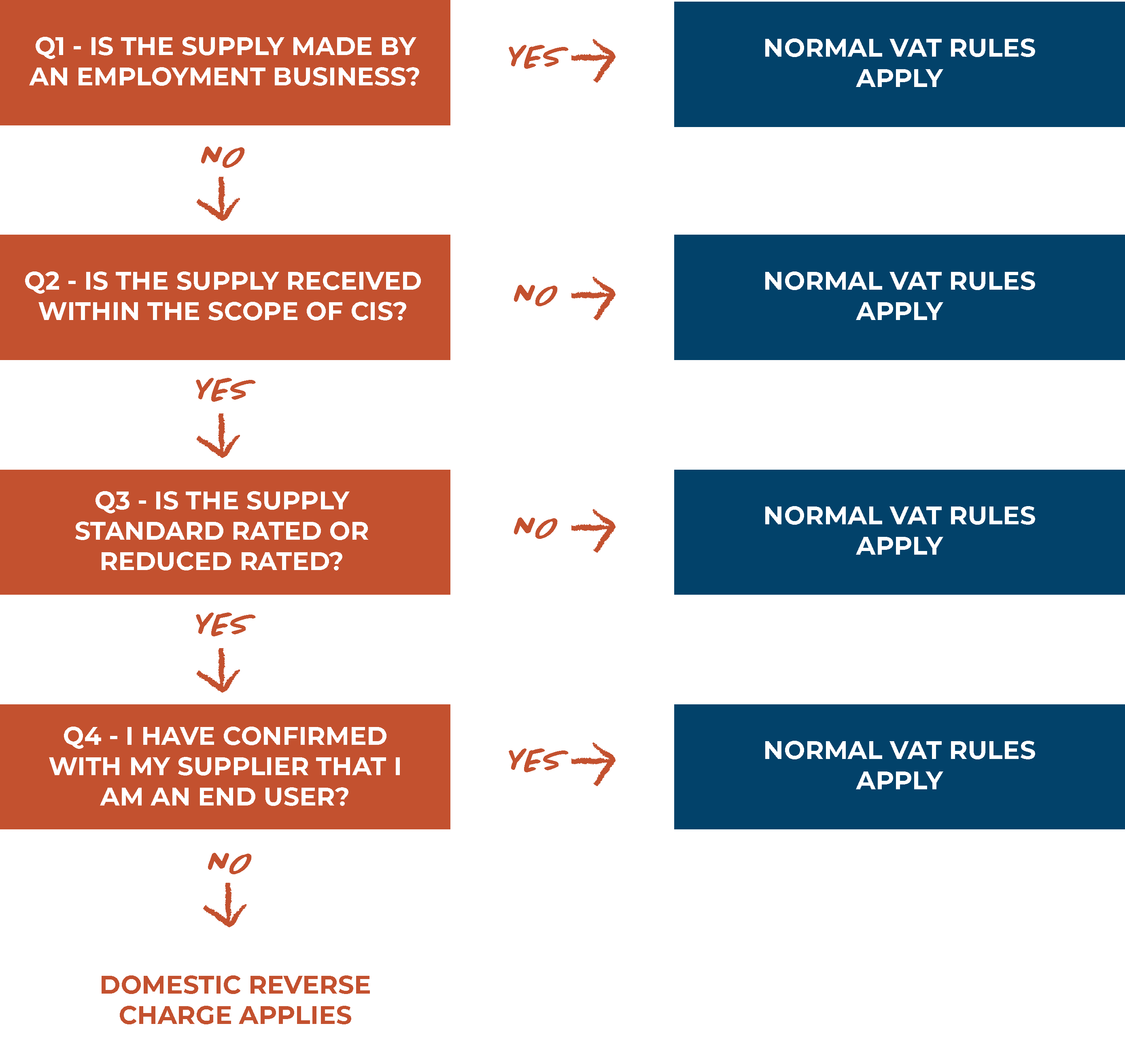

See below flowcharts to assist in deciding if the reverse charge needs to be applied.

If you sell building and construction services:

If you buy building and construction services:

INVOICES

If you are a subcontractor invoicing a contractor in a supply chain, you will either need to charge VAT as normal or apply the reverse charge. If the supply falls under the reverse charge your invoice must:

- Show all the information required on a VAT invoice

- Make a note on the invoice to make it clear that the domestic reverse charge applies, and that the customer is required to account for the VAT (wording example: reverse charge: Customer to pay VAT to HMRC)

- Clearly state how much VAT is due under the reverse charge, or the rate of VAT if the VAT amount cannot be shown, but the VAT should not be included in the amount charged to the customer

For invoices dated before 1 March 2021 with payment received on or before 31 May 2021 normal rules apply.

For invoices dated after 1 March 2021 or payments received 1 June 2021 or after the new domestic reverse charge rules will apply.

ACCOUNTING FOR THE REVERSE CHARGE

If you use accounting software, we would expect most providers to implement new Domestic Reverse Charge tax rates. This will mean that if the tax rate is selected the software will account for any VAT in the correct boxes.

As an example, Xero has already been set up with new codes which can be added to account for the domestic reverse charge.

Subcontractors may find that they do not have to charge VAT on most of their sales and may start to receive repayments from HMRC on their VAT returns, known as a repayment trader. In this scenario a business may wish to start filing monthly VAT returns to speed up getting repayments due from HMRC.

If you are using the Flat Rate Scheme for VAT any reverse charge sales are excluded from the calculation. If the majority of your sales will fall under the domestic reverse charge the scheme will no longer be beneficial, you will be a repayment trader and could be claiming VAT refunds under the standard scheme. If you make a mixture of supplies, you should consider if a move to the standard scheme would be beneficial.

CASH FLOW

The new domestic reverse charge may have a significant impact on the cash flow of construction enterprises. A cash-flow saving arises for customers receiving reverse chargeable services from subcontractors, but a cash-flow disadvantage arises for those issuing reverse charge invoices.

Contractors applying the reverse charge will no longer be collecting VAT from customers and holding it until the VAT return becomes due, whereas recipients of such services will no longer have to pay out VAT to suppliers and wait to reclaim it from HMRC.

If you need any assistance with this, then please get in touch! You can call our VAT Compliance Manager Yvonne Collings on 01243 782 423 or send an email to [email protected].